Tuesday, October 28, 2008

Impending Doom!

I cannot shake the feeling that the election will not stop the rancor and partisan fighting that we are now seeing.

I see that my prediction in Febraury was wrong; I thought McCain would win over either Hillary or Barack.

But that won't happen.

McCain looked to change his struggling dynamic when he picked Sarah Palin to be his running mate, but she has shown herself to be more interested in herself than in working with McCain to get him and her elected.

She first went a little off the reservation in a few interviews, then found her voice and never looked back.

At least she's a snappy dresser.

Republicans on the far right seem to really like her, and that shows what is the most wrong with the Republican Party right now.

They are adrift.

They have no center, no rallying point.

They started out despising McCain, and then grudgingly accepted him when it became profoundly obvious that he would be the candidate.

And that was a huge mistake.

He could go his own way more than most Republican candidates because he got the nomination without the far right, and so he did.

He picked a bright, attractive bulldog with no following and no serious credentials as his running mate, just to prove he is a maverick.

Unfortunately, a maverick takes the lead and takes all the arrows, though he blazes the trail for others.

And McCain has blazed the trail to a more centrist Republican candidate in the future than we have seen lately.

The right doesn't know or care to know this, but the center is where most Americans spend all their time.

The left is greedily gathering up the spoils of the war they didn't really win, but that they just failed to lose because they had no power to exercise.

Democrats will abuse their power, just as Republicans have, just as almost anyone does when they get much of it.

And the public will stay near the middle, like they always do, wondering when the politicians will stop bickering and start making sense.

I see that my prediction in Febraury was wrong; I thought McCain would win over either Hillary or Barack.

But that won't happen.

McCain looked to change his struggling dynamic when he picked Sarah Palin to be his running mate, but she has shown herself to be more interested in herself than in working with McCain to get him and her elected.

She first went a little off the reservation in a few interviews, then found her voice and never looked back.

At least she's a snappy dresser.

Republicans on the far right seem to really like her, and that shows what is the most wrong with the Republican Party right now.

They are adrift.

They have no center, no rallying point.

They started out despising McCain, and then grudgingly accepted him when it became profoundly obvious that he would be the candidate.

And that was a huge mistake.

He could go his own way more than most Republican candidates because he got the nomination without the far right, and so he did.

He picked a bright, attractive bulldog with no following and no serious credentials as his running mate, just to prove he is a maverick.

Unfortunately, a maverick takes the lead and takes all the arrows, though he blazes the trail for others.

And McCain has blazed the trail to a more centrist Republican candidate in the future than we have seen lately.

The right doesn't know or care to know this, but the center is where most Americans spend all their time.

The left is greedily gathering up the spoils of the war they didn't really win, but that they just failed to lose because they had no power to exercise.

Democrats will abuse their power, just as Republicans have, just as almost anyone does when they get much of it.

And the public will stay near the middle, like they always do, wondering when the politicians will stop bickering and start making sense.

Tuesday, October 14, 2008

Capitalism, Democracy, and Decline

I think the reason we have the problems we are having with our economy now, and the reason these problems have been experienced by much of the developed world at the same time, is our reliance on the Free Market.

We have preached the virtues of the free market to other nations for decades, and they have listened.

We have shown them the prosperity and dynamism that comes with a free market economy.

We have displayed the goods and goodies we can buy because of our use of this economic system.

And we thought the only downside is the necessity to look out for the poor, since this a democratic capitalist system does not automatically provide for them.

But that is not the only danger.

The larger risk, the one that has come to very bad realization now, comes from another aspect of this system.

As long as there are free markets, and capitalist systems, in which companies sell stock to finance their growth and reward their stockholders, there will be the types of difficulties we are now experiencing.

Stockholders demand increases in revenues and profits every quarter.

This is achievable for smaller growing companies and less mature industries, as they expand to fill the demand of the market they serve, and compete with one another for the ability to gather more sales.

This is achievable for mature companies and industries as well, through incremental innovation, introduction of new products or services, and stiff competition.

But there will always be companies and industries that have reached a point at which they have filled all the need, they have in effect saturated their market.

This happened recently with home mortgage providers.

About a decade ago or so, several large and still growing companies that provide mortgages found their growth slowing as they had nearly saturated the American market for their products.

They needed to keep revenues and profits growing as fast as they had on their way up, but there did not seem to be a way to do so.

They could get incremental increases by competing harder with the other major companies selling the same mortgages.

Or, they could find a way to sell to a part of the market that was thought not to exist.

People who could not show good credit or down payments were always previously thought to not be a market for a mortgage, because they would not have the same ability or maybe the same incentive to pay back the loan.

But these people represented a huge untapped market for mortgage providers.

So the major companies providing mortgages started to loosen lending standards, to see what would happen if they began to lend to some of this part of the market.

They found that the losses were a little higher, and they realized they could simply price their loans higher to make up for those losses.

Then these same companies realized they could get more money to make more loans and be more competitive if they could sell more of the loans they did make, and sell them faster. (After the loans were made, good ones were sold to investors giving the mortgage companies more cash to make more loans.)

Wall Street immediately stepped in to offer a way to pool all mortgages in giant groups, even the ones made to borrowers with low credit scores and little or no downpayment.

When these mortgages were bundled into huge packages, others on Wall Street figured out ways to sell of parts of them, with some investors buying some parts of the payments coming from the borrowers, some buying other parts of the payments, others buying bets on how much or little those payments would be in the future, and still others buying complex wagers on how these investments would perform as compared to other investments, and on and on.

In a capitalist, free market, as part of a democracy, public companies have developed an imperative to constantly grow revenues and profits every quarter.

Companies have nearly lost the quaint idea of long term, steady growth.

And none of these companies think it is even conceivable to aim for revenues that hold steady, or flat.

That is truly unthinkable.

You cannot find a publicly traded company that would even consider keeping revenues steady, and profits steady, even if revenues and profits were at an exceptional amount.

And it would be extremely difficult to find a smaller, privately held company that would consider it either.

The requirement to constantly grow revenues and profits necessarily will continue to cause (among some companies in some industries) the behavior that eventually then causes these dire economic problems.

It doesn't mean we should limit growth, we should simply be aware of what it can do to us.

Because financial growth is the imperative, we will continue to see both new and old ways in which growth at any cost ends up costing us all.

We have preached the virtues of the free market to other nations for decades, and they have listened.

We have shown them the prosperity and dynamism that comes with a free market economy.

We have displayed the goods and goodies we can buy because of our use of this economic system.

And we thought the only downside is the necessity to look out for the poor, since this a democratic capitalist system does not automatically provide for them.

But that is not the only danger.

The larger risk, the one that has come to very bad realization now, comes from another aspect of this system.

As long as there are free markets, and capitalist systems, in which companies sell stock to finance their growth and reward their stockholders, there will be the types of difficulties we are now experiencing.

Stockholders demand increases in revenues and profits every quarter.

This is achievable for smaller growing companies and less mature industries, as they expand to fill the demand of the market they serve, and compete with one another for the ability to gather more sales.

This is achievable for mature companies and industries as well, through incremental innovation, introduction of new products or services, and stiff competition.

But there will always be companies and industries that have reached a point at which they have filled all the need, they have in effect saturated their market.

This happened recently with home mortgage providers.

About a decade ago or so, several large and still growing companies that provide mortgages found their growth slowing as they had nearly saturated the American market for their products.

They needed to keep revenues and profits growing as fast as they had on their way up, but there did not seem to be a way to do so.

They could get incremental increases by competing harder with the other major companies selling the same mortgages.

Or, they could find a way to sell to a part of the market that was thought not to exist.

People who could not show good credit or down payments were always previously thought to not be a market for a mortgage, because they would not have the same ability or maybe the same incentive to pay back the loan.

But these people represented a huge untapped market for mortgage providers.

So the major companies providing mortgages started to loosen lending standards, to see what would happen if they began to lend to some of this part of the market.

They found that the losses were a little higher, and they realized they could simply price their loans higher to make up for those losses.

Then these same companies realized they could get more money to make more loans and be more competitive if they could sell more of the loans they did make, and sell them faster. (After the loans were made, good ones were sold to investors giving the mortgage companies more cash to make more loans.)

Wall Street immediately stepped in to offer a way to pool all mortgages in giant groups, even the ones made to borrowers with low credit scores and little or no downpayment.

When these mortgages were bundled into huge packages, others on Wall Street figured out ways to sell of parts of them, with some investors buying some parts of the payments coming from the borrowers, some buying other parts of the payments, others buying bets on how much or little those payments would be in the future, and still others buying complex wagers on how these investments would perform as compared to other investments, and on and on.

In a capitalist, free market, as part of a democracy, public companies have developed an imperative to constantly grow revenues and profits every quarter.

Companies have nearly lost the quaint idea of long term, steady growth.

And none of these companies think it is even conceivable to aim for revenues that hold steady, or flat.

That is truly unthinkable.

You cannot find a publicly traded company that would even consider keeping revenues steady, and profits steady, even if revenues and profits were at an exceptional amount.

And it would be extremely difficult to find a smaller, privately held company that would consider it either.

The requirement to constantly grow revenues and profits necessarily will continue to cause (among some companies in some industries) the behavior that eventually then causes these dire economic problems.

It doesn't mean we should limit growth, we should simply be aware of what it can do to us.

Because financial growth is the imperative, we will continue to see both new and old ways in which growth at any cost ends up costing us all.

Another potential problem that can happen when a powerful country loses economic might, is that they often keep spending on their military as if they are still bringing in the cash they used to.

In an attempt to keep fooling themselves about their power and place among nations, they spend themselves into serious trouble keeping their military huge.

They take resources away from other areas, harming the populace and dissolving research and development, and infrastructure improvements.

The right, and especially the far right, tend to force the military overspending our of fear.

It becomes a vicious cycle, driving GDP lower and harming future competitiveness in the process.

It is something to be aware of, and to avoid.

Best to avoid the overall conditions now that would lead to this potential future.

In an attempt to keep fooling themselves about their power and place among nations, they spend themselves into serious trouble keeping their military huge.

They take resources away from other areas, harming the populace and dissolving research and development, and infrastructure improvements.

The right, and especially the far right, tend to force the military overspending our of fear.

It becomes a vicious cycle, driving GDP lower and harming future competitiveness in the process.

It is something to be aware of, and to avoid.

Best to avoid the overall conditions now that would lead to this potential future.

This election is coming dangerously close to all-out political party war.

Next comes shoooting in the streets.

I have become even more disillusioned by the vitriol from the fringe on both sides of the political spectrum.

William F. Buckely, Jr. once wrote:

"I have spent my entire lifetime separating the right from the kooks."

Too bad Bill is gone. We need someone to do so for both sides.

We must find a way to talk about the issues, and not pass on snide, cruel, fantastically vicious rumors about each presidential cnadidate.

Our country needs leaders who can tell us the truth about the holes we have dug for ourselves in the housing market, the financial system, and even more so, Medicare and our crumbling infrastructure.

It is time for us to work together as one nation, to collectively sacrifice some consumption for savings, investment, and improvement of our country.

If we do not, our competitive position internationally will not recover, and we will move inexorably down the list of influential and powerful countries.

We may actually have to get used to being less than number one in economic might, and as we give away that place to another country, likely China, we will also be ginving away our place as number one in military might.

Economic supremacy affords military supremacy.

We may well have to get used to depending on the better instincts of other countries for our physical safety.

This is something we have not had to understand or accept since Britain slipped in the early part of the 20th century, and we took their place.

It lasted a little over a hundred years.

Maybe that is all that a superpower can hope for.

You hold the place for a century, and then you give it away by your own ineptitude and short-sighted thinking and behavior.

Are We Going To Lose Power And Influence Now?

Do We Have A Choice?

I hope we have a choice, and I hope we can find the will to avert that decline.

We don't know how to be any other way.

Next comes shoooting in the streets.

I have become even more disillusioned by the vitriol from the fringe on both sides of the political spectrum.

William F. Buckely, Jr. once wrote:

"I have spent my entire lifetime separating the right from the kooks."

Too bad Bill is gone. We need someone to do so for both sides.

We must find a way to talk about the issues, and not pass on snide, cruel, fantastically vicious rumors about each presidential cnadidate.

Our country needs leaders who can tell us the truth about the holes we have dug for ourselves in the housing market, the financial system, and even more so, Medicare and our crumbling infrastructure.

It is time for us to work together as one nation, to collectively sacrifice some consumption for savings, investment, and improvement of our country.

If we do not, our competitive position internationally will not recover, and we will move inexorably down the list of influential and powerful countries.

We may actually have to get used to being less than number one in economic might, and as we give away that place to another country, likely China, we will also be ginving away our place as number one in military might.

Economic supremacy affords military supremacy.

We may well have to get used to depending on the better instincts of other countries for our physical safety.

This is something we have not had to understand or accept since Britain slipped in the early part of the 20th century, and we took their place.

It lasted a little over a hundred years.

Maybe that is all that a superpower can hope for.

You hold the place for a century, and then you give it away by your own ineptitude and short-sighted thinking and behavior.

Are We Going To Lose Power And Influence Now?

Do We Have A Choice?

I hope we have a choice, and I hope we can find the will to avert that decline.

We don't know how to be any other way.

Thursday, October 2, 2008

Or Something Like That...

The U.S. Economy is smelling as sour as year-old milk, banks are deep-sea diving, cars are not going anywhere, new houses may have lights on but nobody's home, and the rest of the world is empathizing to an alarming degree.

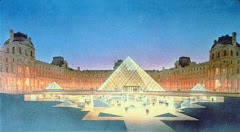

Time to move to France!

No, wait, France's economy turns out to be all bubbles, no champagne.

Just like the rest of Europe right now.

And Asia's is still treading water, but Russia's is threatening to become a real bear.

Is the another Great something or other?

Recession, Depression, Implosion, Erosion?

I dont' know...

But I think if we can't get credit to loosen up across the world, we may teeter on the totter closer to the worst of those.

And how to loosen credit?

Give the power to spend almost a Trillion Dollars to the Treasury Secretary, of course.

Hey, who the hell knows, it just might work!

Of course, it may also put us into a toilet-bowl spin downward into the sewers of history, but it'll be a fun ride nonetheless!

Time to move to France!

No, wait, France's economy turns out to be all bubbles, no champagne.

Just like the rest of Europe right now.

And Asia's is still treading water, but Russia's is threatening to become a real bear.

Is the another Great something or other?

Recession, Depression, Implosion, Erosion?

I dont' know...

But I think if we can't get credit to loosen up across the world, we may teeter on the totter closer to the worst of those.

And how to loosen credit?

Give the power to spend almost a Trillion Dollars to the Treasury Secretary, of course.

Hey, who the hell knows, it just might work!

Of course, it may also put us into a toilet-bowl spin downward into the sewers of history, but it'll be a fun ride nonetheless!

Subscribe to:

Posts (Atom)

_-_The_Birth_of_Venus_(1879).jpg)